You know what kills a good business deal? Running out of cash at the wrong moment.

When you need shipping containers for your construction site or extra storage space, paying $3,000-$5,000 upfront can put a real squeeze on your working capital. Smart business owners in Florida and Georgia have figured out there’s a better way.

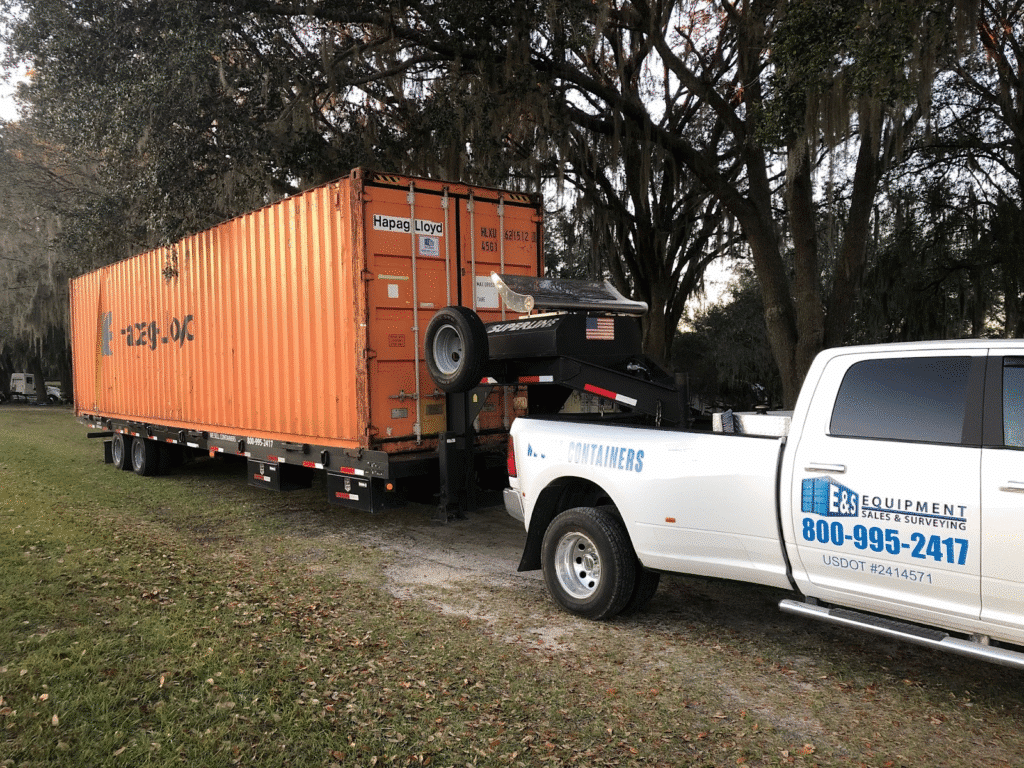

Since 2010, we’ve watched thousands of customers navigate container financing decisions at E&S Equipment. Some choices work out great. Others create headaches down the road.

Here’s what we’ve learned about making container purchases without emptying your bank account.

Why Finance Instead of Pay Cash?

Let me tell you about a contractor in Tampa who needed four 40ft containers for a six-month project. He could have paid the $18,000 upfront, his business account had the funds. Instead, he chose financing and kept that cash for payroll and materials.

Three weeks later, a bigger project came up. Having that $18,000 available meant he could take the job. The financing payments? Around $400 monthly, which his new contract more than covered.

Cash isn’t just money sitting there, it’s an opportunity.

Your Container Financing Options

Different situations call for different approaches. Here’s what actually works:

Equipment Loans for Container Purchases

The container serves as collateral, which usually means better rates than unsecured loans. Most lenders understand container values pretty well these days.

Works best for: Established businesses planning long-term use

Typical terms: 8-12% APR with good business credit

Container types: All sizes from 10ft to 45ft containers

Business Credit Lines

Pay interest only on what you use. A landscaping company near Atlanta uses this approach , they draw funds for extra containers during busy spring months, then pay down the balance when things slow down.

Works best for: Seasonal businesses or multiple container purchases

Advantage: Flexibility for modifications and additional purchases

Personal Loans for Containers

Sometimes the fastest path, especially for smaller projects or personal use.

Works best for: Individual storage needs or new businesses

Consider for: Single container purchases under $5,000

Skip the Credit Hassles With Rent-to-Own

Traditional container loans often create barriers. Credit checks, documentation, waiting for approval, all while your project timeline ticks away.

Our program works like this:

No Credit Checks Required

We focus on your ability to pay, not past financial bumps. Provide proof of income and you’re typically approved.

Simple Requirements:

- Income verification

- First and last month payment

- That’s it

Flexible Terms Available:

Choose 12, 24, 36, or 48-month terms. Shorter terms mean higher monthly payments but lower total cost.

Early Payoff Rewards:

Business improves? Pay off early with a discount. No penalties for getting ahead.

True Ownership:

Complete your payments and the container is yours. No balloon payments or surprise fees.

Learn more about how our rent to own works.

Matching Container Grade to Financing Strategy

The type of container you choose affects both your financing terms and total cost:

New One-Trip Container Financing

These containers made just one overseas voyage. Perfect when appearance matters or you need that “like new” look. We don’t know what cargo was transported, even in new containers.

Financing sweet spot: 36-48 month terms work well with their 18-20 year lifespan

Popular sizes: 40ft high cube ($4,500-$5,900) for maximum space, 20ft standard ($3,200-$3,900) for budget-conscious buyers

Monthly payments: Typically $125-$165 for 40ft units, $90-$110 for 20ft units

Used Cargo Worthy Container Loans

These units already have 8-14 years of life removed from their original 18-20 year shipping lifespan, but still meet shipping standards. Our licensed surveyor inspects every cargo worthy container to guarantee structural integrity.

Smart financing: 24-36 month terms capture value without overextending

Best sellers: 40ft standard ($2,600-$3,200), 40ft high cube ($2,700-$3,600), 20ft standard ($2,100-$3,000)

Monthly range: $75-$110 for 40ft containers, $60-$85 for 20ft units

Wind/WaterTight Storage Container Financing

Perfect for domestic storage, guaranteed leak-free but don’t meet overseas shipping standards. Great value for Florida and Georgia storage projects.

Budget-friendly terms: 12-24 months keeps payments manageable

Most economical: 20ft containers for basic needs, 40ft for larger requirements

Payment range: $55-$90 for 40ft containers, $40-$65 for 20ft containers

Business vs Personal Financing: Tax Implications Matter

How you structure your container purchase affects more than monthly payment , it impacts your tax bill too.

Business Container Financing Benefits:

- Monthly payments typically qualify as deductible business expenses

- Depreciation deductions spread over 5-7 years

- Section 179 may allow immediate expense deduction

- Interest payments are business deductions

- Builds business credit separate from personal credit

Personal Container Loans:

- No tax deductions for personal use

- Affects personal debt-to-income ratios

- Makes sense for container homes or personal storage

Watch Out for Hidden Costs

Some container financing companies load up the fees. Here’s what to avoid:

Origination Fees: Can range 1-8% of loan amount

Early Payment Penalties: Some lenders charge fees for paying off early

Documentation Fees: Application charges, credit check fees, processing costs

Surprise Delivery Charges: Always confirm delivery is included

When we quote a monthly payment, that’s exactly what you’ll pay. No hidden fees or surprise charges.

Container Payment Comparison: Rent vs Finance vs Buy

Should you rent, finance, or buy outright? The math depends on your timeline:

Renting Makes Sense (6-18 months):

- Temporary projects with clear end dates

- Testing storage solutions before committing

- Monthly rental: $150-$250 for 40ft, $120-$180 for 20ft

Financing Works Best (1-4 years):

- Medium-term needs with ownership goals

- Want to preserve cash for other investments

- Monthly payments: $96-$165 for 40ft (36 months), $75-$110 for 20ft

- Total cost: $3,500-$6,000 for 40ft, $2,700-$4,000 for 20ft

Buy Outright When:

- Permanent storage needs (5+ years)

- Strong cash position with good reserves

- Need modification freedom immediately

- Cash price: $4,500-$5,900 for 40ft new containers, $2,600-$3,600 for 40ft used, $2,100-$3,900 for 20ft containers

The break-even point between renting and financing usually hits around 18-24 months.

Read our full guide on renting vs buying storage containers!

Container Financing Timeline

Knowing approval timelines helps you plan better:

Same Day to 24 Hours:

- Rent-to-own approvals

- Some online personal loans

1-5 Business Days:

- Most personal loan programs

- Equipment financing with good credit

5-10 Business Days:

- Traditional bank equipment loans

- Business loans through conventional lenders

Container Delivery Timeline:

- In-stock containers: 7-12 days from order confirmation

- Custom-sourced containers: 7-12 days depending on availability

- Standard modifications: 3-4 weeks for door additions, paint, etc.

Apply early to ensure container availability for your project start date.

Step-by-Step Container Financing Process

1. Determine Your Container Needs

- 20ft containers: Smaller storage needs, easier financing, lower payments

- 40ft containers: Maximum storage, popular for business use, higher payments but better value per square foot

- New containers: Premium quality, 18-20 year lifespan, best for customer-facing applications

- Cargo worthy containers: Certified for shipping, excellent value with decades of life left

- Wind/water tight containers: Most affordable for domestic storage applications

2. Check Your Credit and Business Situation

- Good credit (650+): Equipment financing with best rates

- Fair credit (580-649): Personal loans or higher-rate business financing

- Poor/no credit: Rent-to-own programs with income-based approval

3. Calculate Total Cost

- Add up all interest over the loan term

- Factor in tax benefits for business purchases

- Consider early payoff discounts vs penalties

4. Match Terms to Usage

- Short-term projects (1-2 years): Compare renting vs short-term financing

- Medium-term needs (2-4 years): Sweet spot for most financing options

- Long-term use (5+ years): Lower payments with longer terms or buy outright

Why Work with E&S Equipment for Container Financing?

After serving Florida and Georgia for over a decade, we’ve heard plenty of financing horror stories. Surprise fees, changing terms, hidden costs, unfortunately common in container financing.

We built our program around what customers actually wanted:

Transparent Pricing – Your quote is your final price

No Credit Check Options – Approval based on ability to pay, not credit history

No Hidden Costs – No origination fees, processing charges, or surprise expenses

No Placement Charges – We don’t charge extra for container placement on your property

Early Payoff Benefits – Discounts instead of penalties

Licensed Container Expertise – Our owner is a licensed container surveyor with decades of experience

Professional Service – Living up to our “Better Containers, Professional Service” commitment since 2010

Our Warranty Coverage:

- New 1-trip Containers: 5 Years

- Cargo Worth/Used: 2 Years

- Wind & Water Tight: 90 days

Every container we finance includes proper CSC certification when required. Our licensed inspection process means you get exactly what you’re paying for.

Whether you’re managing construction site storage, expanding warehouse capacity, or planning custom modifications in Florida or Georgia, our financing works for your situation. We understand both containers and financing because we’ve been successfully doing both for over a decade.

Learn more about financing with E&S.

Start Your Container Financing Today

The best time to explore container financing is before you desperately need the containers. When deadline pressure hits, you’re more likely to accept unfavorable terms.

Start by figuring out what monthly payment fits comfortably in your budget. This isn’t just about what you can technically afford , it’s about leaving room for other business needs and opportunities.

Your first step should be a conversation about your specific container needs and timeline. We’ll walk through financing options that make sense for your situation , with no hidden costs, no credit checks required, and no surprises.

Ready to explore container financing?

Call E&S Equipment at (904) 703-0507 to discuss financing solutions for your construction site storage, warehouse expansion, or portable storage needs. Serving Florida and Georgia with better containers and professional service since 2010.

Common Container Financing Questions

What credit score do I need?

Equipment financing typically wants 650+, personal loans start around 580-640, and rent-to-own programs often require no credit check.

Can I finance a used container?

Absolutely. Most programs work with both new and used containers. Used containers often provide the best value , significant savings with decades of useful life remaining.

What’s the difference between financing a 20ft vs 40ft container?

Mainly loan amount and monthly payment. 40ft containers cost more but offer double the storage space.

Can I finance container modifications?

Yes, our financing covers both standard containers and modifications. Whether you need basic additions like man doors and windows, or complete office conversions with electrical and HVAC, the financing approach stays the same.

Better to finance or buy cash?

Yes, our financing covers both standard containers and modifications. Whether you need basic additions like man doors and windows, or complete office conversions with electrical and HVAC, the financing approach stays the same.

Recent Comments